》Check SMM copper quotes, data, and market analysis

》Click to view the historical price trend of SMM spot copper

Copper prices fluctuated amid tariff disruptions, with copper billet producers' operating rates showing resilience amid divergence in April

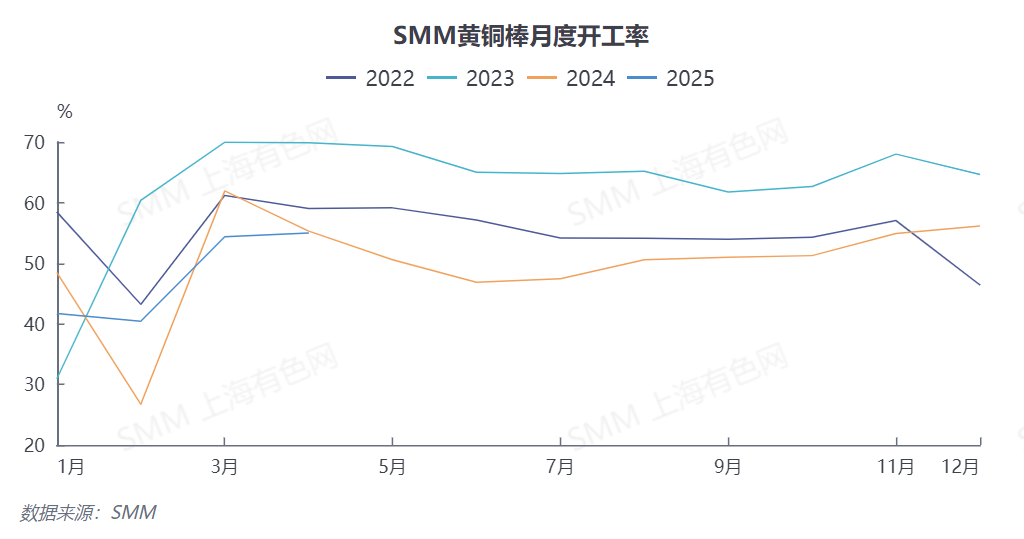

According to SMM data, the operating rates of copper billet producers reached 54.97% in April 2025, up 0.58% MoM. By scale, the operating rate of large enterprises was 58.19%, that of medium-sized enterprises was 54.45%, and that of small enterprises was 36.38%.

The copper billet market in April presented a complex operational landscape. Affected by tariffs at the beginning of the month, copper prices fell sharply. Downstream buyers, adhering to the market psychology of "rush to buy amid continuous price rise and hold back amid price downturn," generally adopted a wait-and-see attitude, leading to a reduction in order sizes. However, the low copper prices also prompted some enterprises to release order demand, creating a brief purchasing window. As the macroeconomic situation eased, copper prices returned to fluctuating at highs. The high raw material costs significantly suppressed the stockpiling enthusiasm of downstream enterprises, and purchase willingness weakened again. From the perspective of inventory data, the days of raw material inventories of SMM sample enterprises increased by 0.22 days MoM to 7.48 days, while the days of finished product inventories decreased by 0.36 days MoM to 8.95 days. Overall, despite a decline in the orders of copper billet producers in April, the market remained relatively balanced through dynamic adjustments on both the supply and demand sides, roughly equivalent to the operational level in March.

Amid high copper prices and weak demand, the operating rates of brass billet producers in May may experience a significant decline

According to SMM, the market expects the operating rates of copper billet producers to show a downward trend in May. Some enterprises reported that current order volumes have decreased by approximately 20%-30% YoY. Therefore, SMM forecasts that the operating rates of copper billet producers will decline by 5.05% MoM to 49.92% in May. The specific reasons are as follows:

Firstly, there is significant pressure on the raw material side. Copper prices continue to fluctuate at highs, and the price spread between domestic and overseas markets is inverted. Given the high reliance of brass billet production on overseas raw materials, the current supply of spot resources at various local yards is tightening, and the raw materials previously stockpiled by enterprises have been exhausted. With the cost transfer mechanism obstructed, enterprises find it difficult to pass on the soaring raw material costs to downstream, thereby suppressing both the willingness and ability to undertake orders.

Secondly, seasonal demand is weakening. Entering Q2, the brass billet market has entered the traditional off-season for sales. Coupled with the suppression of downstream purchase willingness by high copper prices, market demand remains sluggish, and the outlook for subsequent order growth is not optimistic. In addition, adjustments to international trade tariff policies have had a significant impact on the exports of brass billet downstream end-use products such as valves and home appliances, with the operating rates of some export-oriented enterprises already dropping to cyclical lows.

Overall, under the dual pressures of high copper prices and weak demand, the short-term industry prosperity will continue to decline.